America’s Double Standard

Many people welcomed President Biden’s announcement regarding his decision to forgive a portion of each individual’s student debt. By doing so, he fulfilled a campaign promise made during his candidacy in 2020. However, Republicans in congress argued that canceling student debt sends the wrong message and that it is unfair to borrowers who had fulfilled their obligation.

I, like many students, know the considerable sacrifice required to pursue a college degree. It is not a decision that should be taken lightly. Attending college requires committing your time and resources in order to earn a degree. The cost of attending college has risen exponentially over the last few decades. The National Center for Education Statistics estimates that the cost of tuition in 1970 was around $394 whereas nowadays tuition at a public institution is $10,560 on average. This equates to 2,580% not accounting for inflation. Whereas $394 in 1970 is worth approximately $2,440 today when accounting for inflation. Even when adjusting for inflation, it is obvious that college tuition has skyrocketed. Costs associated with college present a major barrier to entry for many people hoping to venture into higher education. However, a generation of people has been raised with parents, teachers, and counselors expressing how important and crucial higher education is for success in America. This is one of the main things I remember about my high school experience. It felt as though nearly every aspect of my time in high school was priming me for a transition to college.

Many students coming out of high school view higher education as the de facto next step. They also exit high school with minimal if any financial literacy. Unfortunately, this creates a huge opportunity for lenders. A study by Business Insider claims that 27% of millennials surveyed were not aware of the actual terms of their loan. Many of them underestimated the effect of compound interest. I view this as a predatory practice by lenders and I do not place the blame or responsibility for this debt epidemic on people who are simply trying to obtain a college education. As a society, we should be thrilled that other members are working to better themselves. An old adage comes to mind: “a rising tide raises all ships.”

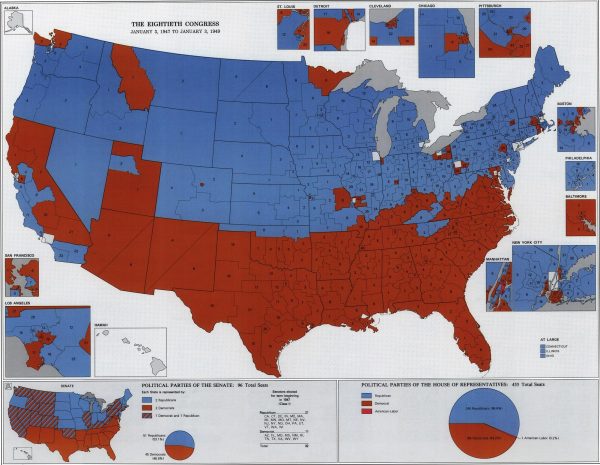

Furthermore, this announcement has provoked the ire of many conservatives across the country. I have many friends and family who feel that by forgiving the debt of a person you are not holding them accountable. To me, this illustrates the disturbing double standard we have in this country. The United States has a reputation for providing corporations with financial safety nets on the taxpayers’ dime. In 2008, taxpayers were asked to foot the bill to rescue banks that were considered too big to fail. Taxpayers again came to the aid of the American automotive industry. Lastly, who can forget the paycheck protection program launched by the Trump Administration at the beginning of the COVID-19 pandemic. The majority of those loans were forgiven.

Also, the student debt crisis is compounded by stagnant wages in the United States. The U.S. Department of Labor states the minimum wage in 1970 was $1.60. A student could work five hours per week and afford tuition. Today the minimum wage is $7.25. A student needs to work at least 28 hours per week in order to afford tuition today. A student who does not receive grants or aid will be approaching full-time employment in order to afford their education.

As we can see America does not have a history of holding corporations accountable for their actions, so why should the average person not have a measly $10,000 forgiven? Ultimately, I think this decision is an example of America’s love affair with corporatist capitalism. We rarely question banks or corporations when they require a massive undertaking to remain solvent. However, we expect the average joe to “pull themselves up by their bootstraps.” I for one am happy that across the country, people can unburden themselves of debt that they have carried for far too long.

For a more in-depth analysis of the implications of the Biden Administration’s decision read Tamira Singleton’s article Biden Announces Student Loan Relief for Borrowers Who Need It Most.