Impact of Interest Rates and Inflation on the Country

You all probably have been hearing conversations about interest or inflation or have even been affected by it within your expenses. So, what are interest and inflation, and how do they affect our lives?

First, we must understand the terminology that helps explain the economy. The economy itself represents how we as a country allocate resources. Interest rates show you how much you are being charged as a borrower. Inflation is the increase of prices for goods and services to balance levels. Gross domestic product, or GDP, is the measurement of market value and the country’s economic well-being. Usually measured in a year, it counts for all goods, services, and products produced in the country. And a recession refers to a decline in economic activity. All these terms are important because they’re helpful indicators of the success of the economy.

Now, who decides whether the country’s economic performance is good or not? The Federal Reserves of the United States are responsible for decision-making regarding raising or lowering interest rates and inflation. There are a total of eight Federal Reserve meetings, discussing the economy and possible policy options. According to the U.S. Bureau of Labor Statistics, consumer prices went up to a staggering 9.1 percent in June, the biggest increase in almost half a decade. The current rates in the country are all around 8.3%.

Are interest rates being high an indicator that we are entering a recession? To know we are in a recession, we must look at other factors other than interest rates. Our GDP has decreased since last forecasted and has been decreasing for the past few months. In general, if the GDP is low for more than two consecutive terms/quarters, then we are hitting a recession. If interest is being increased by the federal reserves, then we are hitting a recession. The only signifying update that is needed is an official announcement from the U.S. Government. There has been talk about confirmation of the economy shrinking and business cycles becoming on the short end, however, as I stated before, no official announcement has been made.

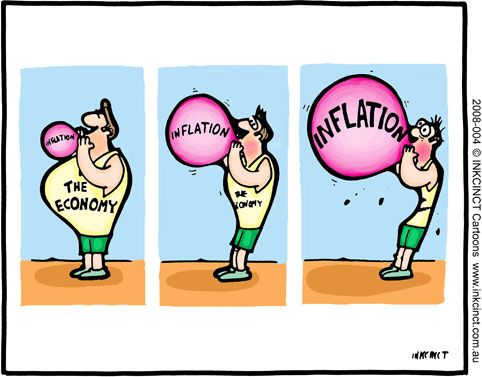

If the U.S. Government has yet to announce an official claim, then why are interest rates still high and affecting different goods and products? Just because the U.S. Government has not officially made a statement on a recession, does not mean the economy is not still suffering. Interest rates are high to try and combat the rise in inflation and regulate price growth. Inflation is high because product cost is in demand. An example of this is energy shortages like gas being impacted by the ongoing war of the Russia-Ukraine conflict. Over the summer, the whole nation felt the effects of inflation on gas prices. Rates on gas prices increased because the demand levels were not matching production. In turn, the prices increased to try and balance the number of consumers.

The Federal Reserves and Conference Board Economic Forecast are expecting the GDP growth to return to positive territory and the growth officially slowing down. A great way to understand economic development is the “Goldilocks and the three bears” analogy. If inflation is too slow (cold porridge), then economic growth grows stale. If inflation is too high (hot porridge), the economy is overloaded. However, if inflation is balanced correctly (neither too hot nor too cold porridge), then it stays between the 2% figure that the Federal Reserves have established.